The World of GNSS: GPS is Not the Only Service in the Sky - Discussion on current and emerging GNSS systems

The U.S.-based global positioning system (GPS) is used internationally, but is facing a slew of competitors which are looking to take away some of its market share. Instead of re-hashing much of what you have read elsewhere, this article will concentrate on understanding where the market for GPS is today, and where it may be headed by comparing it to the computer PC operating system and software market sector(s). Interesting lessons emerge when such parallels are drawn. But, first, we need to define the technology and the (current) players.

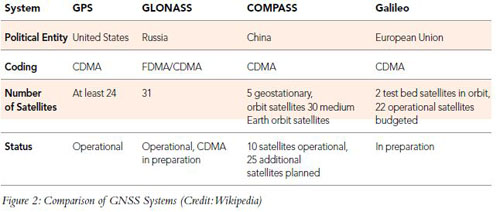

At the moment, the U.S.-provided GPS is one of two (main) operational Global Navigation Satellite Systems (GNSS), with Russia’s GLONASS being the other. Both of these began in the Cold War, and have been upgraded over the years for commercial use. (Let’s ignore the military implications for the sake of brevity). Figure 1 on the opposite page shows the main existing GNSS’ and key announced systems, some of which will only provide regional navigation rather the global service that GPS and GLONASS provide. All of these planned systems are in an advanced state of development, so expect them to happen.

A Long Way From Signal Fires

Navigation has evolved from our initial attempts of signal fires, paper maps with key landmarks identified in Jeppeson’s hand-drawn chart book which also had local farmers telephone numbers (another article for another day…) and radio navigation. Rather than re-hash the long history of aviation navigation here, let’s concentrate on where it’s headed.

The current U.S.-owned GPS system is being upgraded to provide better, faster and more accurate services as needed by the forthcoming NextGen system. One of the key tenants of NextGen is that voice communications from pilot to ground become secondary, and automated machine-to-machine connectivity will provide better management of the aviation ecosystem by replacing many manual processes. This will allow more aircraft more safety and allow them to operate closer together and land more precisely than ever before. GPS capabilities drive all of this, since the entire NextGen air traffic management system is dependent upon knowing EXACTLY where you are, where you are headed and how fast you are getting there. This is an oversimplification, but, GPS essentially drives all of this.

So, the forthcoming version of GPS, referred to as GPS III, is scheduled to begin launch of the first of 24 satellites in 2014. It’s now being built to bring new future capabilities to both military and civil positioning, navigation and timing (PNT) users globally, and will preserve GPS’ role as the “Gold Standard” for GNSS.

Technology Ages Fast

The current GPS system became operational in the mid-1990s, which in ‘Internet time’, is, well, a long time ago. Think about it. Back in 1995, Netscape Navigator was the most-used browser (Microsoft launched the first version of Internet Explorer that year), and the main search engines were Yahoo, InfoSeek and Lycos (remember these names?) since they operated portals. So, GPS was long overdue for a much-needed overhaul. Especially since today’s cars use GPS technology to navigate around rush hour traffic jams, and this technology is more advanced that what is used to navigate many of today’s aircraft in the current air traffic control system. We are in a definite need of a major overall system upgrade, as well as in aircraft avionics handling such navigation tasks.

Another factor driving the update of the current GPS system is competition. Basically, GPS is starting to look like the Microsoft Windows operating system, long dominant but no longer cutting edge (despite the updates). It works just fine (usually), but, it does really excite anybody. Russia’s GLONASS has been resuscitated in recent years, but has not offered serious competition, so we can liken that to the UNIX operating system (which has a small base of fervent users and is dominant in specific application areas). GLONASS is similar to GPS in many ways, but lacks some of the refinements and has lost the commercial battle. (Russia is rumored to start requiring that electronics manufacturers with GNSS capabilities support GLONASS for sales within Russia, so, Nokia, Apple and Samsung have already added this to some of their newer cellular handsets, as has EMS/Honeywell for certain products sold into that region). GLONASS has suffered from reliability issues in the past, and with technical issues due to some bad choices in design years ago (which has being addressed with upgrades now). But, GLONASS has been used significantly in the terrestrial survey industry, where builders of high precision receivers, such as Trimble and TopCom, have successfully offered unified GPS/GLONASS units for specialized products. Both GPS and GLONASS are free services but neither offers Galileo’s promised commercial fee-based assured levels of performance. GLONASS mirrors the example of UNIX and both are more of niche products used in specific regions/applications and lack mass appeal for general use, but both have a place in the world today.

China’s Compass system is a bit of a mystery on how it will compare to GPS III once it is operational, but, with their large internal market and strong base of electronics manufacturers (which can be ‘encouraged’ by their government), you simply know that this will be a commercial success. You can draw comparisons to Compass being like Apple back in late 1990s perhaps (when Steve Jobs returned for an encore and drove Apple to design the iPod, among new products, saving it from irrelevancy or bankruptcy). Apple has its legions of fans, who will buy anything that it churns out. China has a billion people and its products are sold globally. So, if the Chinese government requires that all aircraft navigation components used within China (and for the many governments around the world it supports) have Compass-compatible capabilities, voila! — We have a commercial success. In fact, the announced features of Compass are not quite up to par with GPS III and Galileo, but, as we all know it is marketing sizzle or retail muscle that can drive sales (Hello, Apple). Expect surprises here in a few years. In fact, we can liken Compass to the reduced operating system that Apple has developed for its iPhones and iPads, iOS. When it first debuted, iOS did not garner much respect from Microsoft and others, but, after a few upgrades to the software and the sexy devices which house it, iOS has effectively won the battle of OSs on devices (with more battles to come … especially with Google’s Andriod and the forthcoming Microsoft Windows 8). So, the lesson learned here is not to count out China in regards to GNSS, since it is not always the best technical system which wins commercially, but the one which appeals to end-users the best and controls the electronics chipsets that drive devices. Let’s see if the spirit of Steve Jobs emerges in a satellite control center in Beijing.

The European Union’s Galileo system can probably take credit for pushing the U.S. the most to upgrade. When the EU decided not to depend upon GPS for all of its needs (we use to have a kill switch in GPS to knock out service selectively, which is being phased out now) and develop its own capability, this probably helped spur the U.S. to upgrade our GPS system. It’s reasonable to compare Galileo to a pre-IPO Google, since IPOs are risky, and most lose money for investors. But, every now and then when the stars align properly (pun intended), expectations are met and then surpassed. Galileo has the capability to spur yet more innovation, especially if China and Russia decide to invest in even further upgrades to surpass the EUs planned services. The Galileo satellite constellation will be generally compatible and (mostly) interoperable with the GPS and GLONASS systems. The yet-to-be-operational Galileo service will have a combination of free and paid premium services, and in our analogy, it can be compared to Google’s Android operating system (for phones and tablet computers) before it was publicly available since it competes directly with GPS (Microsoft Windows), GLONASS (UNIX) and Compass (Apple iOS). Google earns its revenue stream from ads derived by users of its various services, and the Android platform is essentially another platform to drive more revenue, as supported by additional services. Galileo partially follows this (outside of directly charging customers, which Google rarely does). Let’s see if the EU has a Google IPO on its hands.

Each major release helps one of these leapfrog the others to appeal to software vendors (i.e. avionics manufacturers), and to end users (all of us).

New Civilian Services Provided by GPS III & Other New Developments

To better understand where each of the GNSS satellite constellations are going, we need to briefly cover some of the key new selling points of the next-generation services.

Originally, the GPS system deployed one type of radio signal, L1 C/A, for civilian use. Three new signals are being added in GPS III (the legacy L1 C/A signal will remain for backward compatibility), and these are the key points of each:

1. L2C: This new signal is clearer and easier to receive than the legacy L1 C/A signal used by most GPS receivers today, and supports challenging environments such as urban settings, under significant tree cover, as well as indoors (there is nowhere to hide). Using L2C with legacy L1 C/A allows equipment to compensate for ionospheric delay error for a particular GPS satellite by comparing the two signals, which addresses one of the main issues for GPS. Present-day civilian GPS is accurate to about three meters, but GPS systems using L2C should be accurate to within approximately one meter.

2. L1C: The L1C signal is designed to make the U.S.’s GPS system interoperable with other GNSS systems, specifically EU’s Galileo, China’s Compass, Japan’s QZSS and India’s IRNSS. L1C provides the original C/A code to ensure compatibility with older GPS models, increases effective power, and it contains a pilot carrier for better tracking.

3. L5: This is the “safety-of-life” signal and was developed specifically for aviation and surface transportation. It’s significantly more powerful as the L2C signal and has superior bandwidth, allowing it to be transmitted more information over longer ranges.

How does this compare to Galileo?

It compares quite favorably. Many of the core services are similar, but Galileo is adding new features which GPS will not have. Galileo will have commercial service which provides five different services:

1. Open service (comparable to GPS)

2. Public regulated service (which safeguards key public services such as police and ambulances)

3. Search-and-rescue service (Galileo satellites will be able to pick up signals from emergency beacons carried on ships, planes or persons and ultimately send these back to national rescue centers which will have the precise location of an accident. Acknowledgement could be sent back to the beacon, which will be a unique service provided by Galileo). This is simply a great idea, and someone deserves a Nobel Prize for thinking of this.

4. Commercial service (essentially the same as GPS III, and this will be encrypted)

5. Safety-of-life service (provision of timely warnings to a user when Galileo is unable to meet certain margins of accuracy). I wish my desktop PC operating system did something like this!

According to the EU, open service, public regulated service and search and rescue service will be operational by 2014, and the other two will follow later. GLONASS is upgrading some of its capabilities to match what GPS III and Galileo are providing, but to a lesser degree.

The Real Competition Has Yet to Begin

While the four main GNSS service providers have some competitive spirit, their sponsoring governments are rarely good at such things. For the most part, the governments will have their hands full with concerns of compatibility and interoperability amongst their systems and trying to get a return on their investment. (Did you think that the U.S. didn’t turn a profit on GPS? Think again. Equipment sales generate sales and other taxes, such as payroll for workers, etc., and income tax on corporate profits). The real battle will be amongst electronics and avionics providers.

Avionics vendors and commercial electronics providers which sell to operators (think iPad or tablet PCs for EFB use, or even smartphones) will offer products which make use of many or all of these four GNSS systems. The spurt of innovation should be interesting as companies target not only aircraft types, but regional sales. If Russia, China and the EU demand that aircraft flying into their airspace support regional GNSS services, the OEMs will have no choice but to provide this to their customers. GPS will no longer be the only GNSS supported. Multilateral agreements will help drive this, and many are in place today already. There are some issues with Compass encroaching on GPS and Galileo frequencies, but there is too much at stake for everyone for this not to be resolved.

Since only two of the four global systems are operational today, not to mention the regional services, avionics OEMs have time to prepare themselves. The expectation is that once all four GNSS satellite constellations are operational (and the regional ones as well) and interoperable, each of these GNSS will have some features which work better than the others and savvy innovators will exploit this to provide better products.

Multi-constellation receivers will drive airborne navigation advancements and will not only decrease costs to end users of this type of equipment, but provide them with options that were not available when GPS was the only satellite system in the sky. Taking advantage of numerous satellite systems and multi-frequency capability, such receivers should profit from improved positioning, velocity and timing (PVT) accuracy and better (and more) satellite signal availability. In fact, one company, Maxim, has already announced a next-generation Global Navigation Satellite System (GNSS) receiver covering GPS, GLONASS, Galileo, and Compass navigation satellite systems on a single chip. This single-conversion GNSS receiver is designed to provide high performance for industrial and automotive applications. Expect avionics vendors to take notice of this soon.

A lot has been done regarding combined GPS/Galileo aviation equipment. Standards have been in work for years at the European Organization for Civil Aviation Equipment (EUROCAE) and Radio Technical Commission for Aeronautics (RTCA). This has not been the case for a Galileo/GLONASS interoperability for civil airborne receivers yet, primarily due to the fact that no obvious signal compatibility and spectrum commonality exists at the receiver level. The types and frequencies of modulations of these two GNSS systems are different. But the forthcoming GLONASS-K modulation scheme will provide a means for interoperability between Galileo and GLONASS. Nokia providing support for GLONASS in their handsets now is causing some concern on how this will affect acceptance of Galileo once it becomes operational.

GPS and GLONASS were standardized many years ago and ICAO has provided written standards to support aviation use, as well as ARINC and other industry standards.

Once other chipset vendors start offering solutions which cover all four GNSS, this will simply be an expected feature. The next battle will be among service providers which provide added functionality on top of the GNSS core offerings, as we have with GPS equipment vendors today. In the automotive transportation market we have $150 GPS devices which provide almost-real-time traffic data for free to customers in North America, Europe and Asia, and then help you change your route to the end-point you were speeding toward. (Disclaimer: the author does not condone speeding … unless you are driving to Las Vegas thru the Mojave Desert on a wide open road … no no, don’t speed). Can you imagine a similar service for General Aviation pilots in congested airspace? (Note to self: patent this idea.)

Another interesting add-on service is for the search-and-rescue capability to be offered by Galileo. You can imagine how many companies will provide additional value-added services for various market niches using this core capability. For those hiking or adventuring off the beaten path in a certain locale, “set-fee” rescues could be quoted or provided via an insurance policy, since instead of dozens of rangers on the ground and multiple aircraft searching for someone for days in some wilderness (or ocean), the unlucky travelers can be reached directly. This saves lives, but also reduces costs and eliminates uncertainties to a large degree, thus creating opportunities for commercial service providers.

Each time the ‘operating system wars’ seem to be over (I believe Microsoft Windows has been declared the defacto winner several times, despite protests from Apple fans), something new has emerged from unexpected places. The clear lesson provided by Apple’s iOS (which powers most of the handheld devices, but not its desktop or laptop computers) with its minimalistic feature set, is that highly-focused lesser-sophistication (technically) products can trump entrenched rivals. Now Google has recently surpassed Apple with its Android OS, since more phones are being launched with this competing software, which is forcing Microsoft to compete harder as well.

So, rather than revel in the ~99-percent market share that GPS currently has, the U.S. needs to be vigilant in how it manages the GPS upgrades and the users which depend upon it. If the technology market has taught us one thing, is that there is ALWAYS someone who will surpass you eventually.

Aviation will benefit greatly from the four (plus two regional) competing GNSS services, and the economy will benefit from a renewed entrepreneurial spurt driven by some of these new satellite navigation driven capabilities. So much as the operating system vendors have learned to cooperate (to some degree), continuous innovation has benefited all consumers and users of computers, tablets and smartphones, and the GNSS market will benefit from a similar scenario.

John Pawlicki is CEO and principal of OPM Research. He also works with Virtual Security International (VSI), where he consults to the DOT’s Volpe Center, handling various technology and cyber security projects. He managed and deployed various products over the years, including the launch of CertiPath (with world’s first commercial PKI bridge). Pawlicki has also been part of industry efforts at the ATA and other related groups, and was involved in the effort to define and allow the use of electronic FAA 8130-3 forms. He recently completed his writing of the ‘Aerospace Marketplaces Report’ which analyzed third-party sites that support the trading of aircraft parts. For more information, visit OPMResearch.com.

John Pawlicki is CEO and principal of OPM Research. He also works with Virtual Security International (VSI), where he consults to the DOT’s Volpe Center, handling various technology and cyber security projects. He managed and deployed various products over the years, including the launch of CertiPath (with world’s first commercial PKI bridge). Pawlicki has also been part of industry efforts at the ATA and other related groups, and was involved in the effort to define and allow the use of electronic FAA 8130-3 forms. He recently completed his writing of the ‘Aerospace Marketplaces Report’ which analyzed third-party sites that support the trading of aircraft parts. For more information, visit OPMResearch.com.